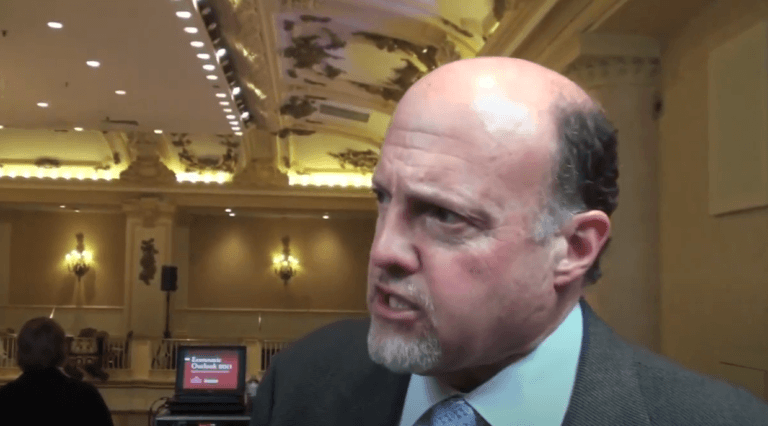

Jim Cramer: There’s No Point to Crypto “Beyond Separating You From Your Money”

August 31, 2022On Tuesday (August 30), former hedge fund manager Jim Cramer warnedCNBC viewers stay away from purely speculative assets.

Cramer is the host of CNBC show “Mad Money w/ Jim Cramer“. He is also a co-anchor of CNBC’s “Squawk on the Street“, as well as a co-founder of financial news website TheStreet.

On June 8, Cramer told CNBC’s “Make It“:

“If you’re a young person and you’re thinking about crypto, I think it’s smart.

“I think crypto should be part of a person’s diversified portfolio. I can’t tell you not to own crypto. I own crypto: I own Ethereum. Why did I buy Ethereum? Because I was in a bidding auction for charity to buy what was known as an NFT, and they wouldn’t let me do dollars. I had to buy it in Ethereum.

“So I researched it, and I said, ‘well, you know, got some qualities I like — scarcity, value — not as hot, so to speak, as Bitcoin. So, I bought it. These are hope securities. Now I don’t like hope. I think you should not ever invest on hope, but these are speculative, and one of the things that I teach in my classrooms is it’s okay to own something that’s speculative.

“You must admit that it’s speculative. So, you don’t put it in the Procter & Gamble class, [it’s] not Coca-Cola, it’s not Apple, but I suggest and accept speculation. Now, when I started Mad Money, I said, ‘I think you should own a spec and I think you should own a gold stock’.

“And ever since crypto came along, I have said that instead of, say, 10% being gold, 5% should be gold and 5% should be crypto. What do I think is the value of crypto? I have no idea. Here’s what I know you’re thinking, though. You’re thinking ‘I have seen fortunes made in crypto and I want a shot at making a fortune’.

“And unlike many of the so-called graybeards who come on TV, I agree with you. You have every right to try to make some money in crypto. I would prefer that you would do it in Ethereum or Bitcoin, which have the largest following, seem like they’re the most legitimate. I would be careful not to borrow money as many people do own these because these are speculative…

“Bitcoin can’t live your house. It’s not a mortgage. It’s a piece of paper, or in this case, it’s not even a piece of paper. So, I don’t want any borrowing. Borrow for your house, borrow for your car, but don’t borrow for crypto, but I would never discourage you from buying crypto because of all the fortunes that have been made and how it could make a whole new group of people fortunes. I’d like that to be you.“

On July 5, Cramer told Joe Kernen on CNBC’s “Squawk Box”:

Right now, it looks like that everything’s bad, and I’m not gonna deny that every asset class is getting hurt. The one I’m most interested in is crypto. There’s a lot of people in crypto. Crypto really does seem to be imploding, but of course we [went] from three trillion to one trillion. Why should it stop at one trillion?

“There’s no real value there. I mean, you look at these companies… There’s these companies that you never heard of and they blew up the weekend, and you jsay to yourself ‘holy cow! there’s six hundred million dollars just going down the drain’, and we had Gary Gensler, the [SEC] Chairman, on a few weeks ago, he just said ‘look, anybody who has a come hither rate of investment… the rate that you earn… you can kind of forget about it’, and that’s what’s happening. How many places can Sam Bankman-Fried save?“

Well, yesterday, when U.S. stocks fell for the third trading day in a row, Cramer had this to say on “Mad Money”:

“We won’t see the end of this decline until we get as a giant washout of all things that are speculative, that don’t make money. This is what it looks like when the Fed gets serious… What matters is that we just have to get through it. In fact, don’t get memed, don’t get SPACed, and don’t get crypto-ed and you’ll get through this ticket and find yourself in a much better time when we are sufficiently oversold for a huge bounce...

“I need you to stay the heck away from unprofitable junk. Profitable’s fine — oil spot, proper oil, profitable tech is fine. I need you to stay away from the sought-out SPACs, the ridiculous IPOs.

“And get ready…Dogecoin, Polkadot, Dai, Polygon, Shiba, Avalanche, Uniswap, Cosmos, Golem, Optimism,… and a couple of other really solid investments that I can get you as long as you like blockchain. There’s no point to any of this stuff beyond separating you from your money.“

https://youtube.com/watch?v=y4AzwEllUnA%3Ffeature%3Doembed

Source: Read Full Article