What is FedNow? The Fed’s New Instant Payment System and Its Implications for CBDCs

August 13, 2023The Federal Reserve has launched a new payment system called FedNow, which will allow banks and financial institutions to perform interbank transactions instantly and at a cost of 0.40 cents, with 24/7 availability.

The FedNow system has been the topic of discussion for many politicians, financial institutions, cryptocurrency enthusiasts, and the average US citizen. So what is FedNow? A prototype for a central bank digital currency (CBDC) or just an instant payment system?

Understanding FedNow

FedNow is a payment system for interbank transactions, exclusive to financial institutions of all sizes and shapes which can access it through FedLine, the Federal Reserve’s electronic messaging system.

Comparing ACH and Wire Transfers

Compared to other interbank transaction systems, we see why FedNow is much needed and desirable to businesses and average citizens.

- In the US, the two most common ways of doing interbank transfers are through ACH and wire.

- However, ACH can take up to 2-3 business days and can either go through FedACH, or EPN, the only private operator on the ACH network.

- On the other hand, wire transfers can take a few hours but are considerably more expensive.

Either way, these two systems have to go through the Fed, which will take care of withdrawing money from the specified issuer and send it to the specified recipient’s account.

FedNow vs ACH, Wire Transfer

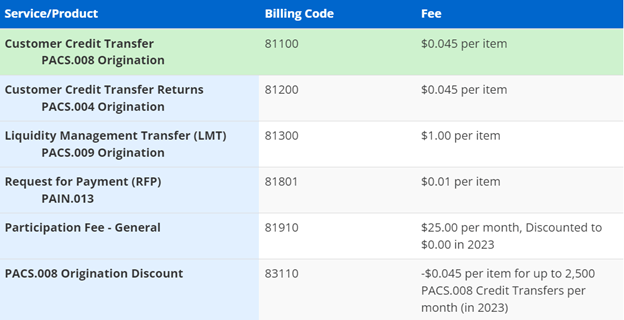

FedNow, on the other hand, provides 24/7 availability, near instant transactions, and with transaction fees as low as $0.045. Here’s a look at FedNow’s 2023 fees schedule:

It’s quite an efficient interbank settlement system that’s much needed for the US financial system, but some people will probably ask themselves why the US didn’t bother to launch it decades ago, considering Europe has SEPA and Brazil has PIX. These systems have been up and running efficiently for several years now.

Going back to FedNow’s structure, it will allow natural people to transfer from $100,000 to $500,000 —though they won’t be using FedNow directly, and will rather use it through banks and financial institutions that will be offering them to clients.

Intermediated CBDCs

The last point is important. FedNow resembles a lot an intermediated CBDC, which is the model proposed by the Federal Reserve a year ago.

Under an intermediated model, the private sector would offer accounts or digital wallets to facilitate the management of CBDC holdings and payments. An intermediated model would facilitate the use of the private sector’s existing privacy and identity-management frameworks.

In short, intermediated CBDCs is a model in which the central bank controls the CBDC but the private sector (the banks) offer accounts and wallets for their users. It’s a bit more complex procedure but that’s the gist of it. By now, it should sound similar to what FedNow is, or can be.

The Fed Speak Phenomenon

What’s more concerning is how Jerome Powell addressed the question of what are the proper legal parameters the Fed needs to follow if it were to launch a CBDC. He said Congress approval is needed for retail and wholesale CBDCs, but doesn’t elaborate on intermediated CBDCs, which leaves a lot of questions in the air, for starters:

- What legal parameters do they need to cover?

- Why doesn’t Powell mention intermediated CBDC?

- And how will this affect the financial privacy and freedom of US citizens?

The way Powell avoids direct questions and employs misleading or confusing comments is a common speech form called Fed Speak, a term coined by Alan Blinder to describe the “turgid dialect of English” used by Fed chair members to speak sentences that have no substance or clear meaning and with as much words as possible.

Another example of this occurred in September 2022, when the House Committee demanded Lael Brainard, the Fed’s former Vice Chair to provide clear and insightful answers to a series of questions regarding how much authority the Fed has for issuing a CBDC and also clarify other testimonies in a May hearing. Instead of answering in a clear, concise manner, she repeated the Fed’s stance on a CBDC.

“The Board’s January discussion paper notes only that, “The Federal Reserve does not intend to proceed with issuance of a CBDC without clear support from the executive branch and from Congress, ideally in the form of a specific authorizing law.”

The first question that pops into mind is, what does ideally mean here? Do they actually need approval from Congress, or are they just going to bypass the law?

Is FedNow a CBDC Prototype?

Shortly after it was announced in March 2023, there were a number of concerns regarding FedNow and its eerie resemblance to a permissioned blockchain; an ecosystem in which only permissioned financial institutions and individuals have control of the blockchain, managing who makes transactions, the amount of said transaction, what will be transferred, block undesired users, etc.

One of the main concerns is FedNow being used to become the next CBDC prototype. And this concern has been voiced by multiple financial institutions and politicians in the US. Tom Emmer issued the CBDC anti-surveillance State Act in order to stop the Fed’s effort of researching and prototyping a CBDC.

Private Banking and Lending: Risks of CBDCs

Credit institutions like The Credit Union Association (CUNA) said that a CBDC is unnecessary, and that the current financial landscape in the US could be modernized and enhanced without destabilizing the economy.

Private banking is another sector where CBDCs could become a radical disruption; crowding out the banks as the government provides the same services without charging. This will not create healthy competition, like the Fed says, but cause people to quit their banks instead and undermine financial markets.

Cyber-security Threats Can Cause Systemic Risk

The second biggest concern is how well the Fed is informed and prepared to create a state-of-the-art infrastructure that’s bulletproof against major hacks and cyber-attacks. A hack into a monetary system, for example, could cause systemic risk since said system contains the information and account access of multiple financial institutions, corporations, government officials, wealthy individuals and the average users.

Integration With Blockchain Systems

Another concern, which is by far the most evident but seemed completely overlooked, is the fact that FedNow integrated with Metal Blockchain, a layer zero (an infrastructure in which layer-1s are built) that complies with the Bank Secrecy Act, therefore they are compliant with anti-money laundering (AML) and know your customer (KYC) laws and this allows Metal Blockchain to provide decentralized finance builders and projects with compliance-friendly options.

But another feature is that Metal Blockchain is built as a fork of Avalanche (AVAX), so it makes sense that they have the X-Chain, which allows builders to create, customize and manage tokens as they please as per their criteria. As per its founders, Metal Blockchain can be used as a foundational layer for CBDCs, allowing a system of “bank chains” that communicate and manage CBDCs.

In theory, a CBDC can be an effective way of modernizing and automating transfers and keeping track of a system’s financial health, avoiding any undesired users or preventing major scams. But it can also become a dangerous tool in the hands of surveillance-obsessed governments and institutions, squeezing what little is left of financial freedom and privacy.

Featured image via Unsplash.

Source: Read Full Article