SEC Employee Slams Gary Gensler’s Regulatory Regime in US: "We Are Shooting Ourselves in the Foot" – Coinpedia Fintech News

May 11, 2023The crypto industry is currently in a state of anticipation as it awaits a resolution in the prolonged legal battle between XRP and the SEC. The outcome of this case will likely have far-reaching implications for the industry as a whole. At a recent Financial Times conference, as reported by Reuters, Hester Peirce, a commissioner at the U.S. Securities and Exchange Commission, expressed her pessimism regarding the current regulatory framework in the United States.

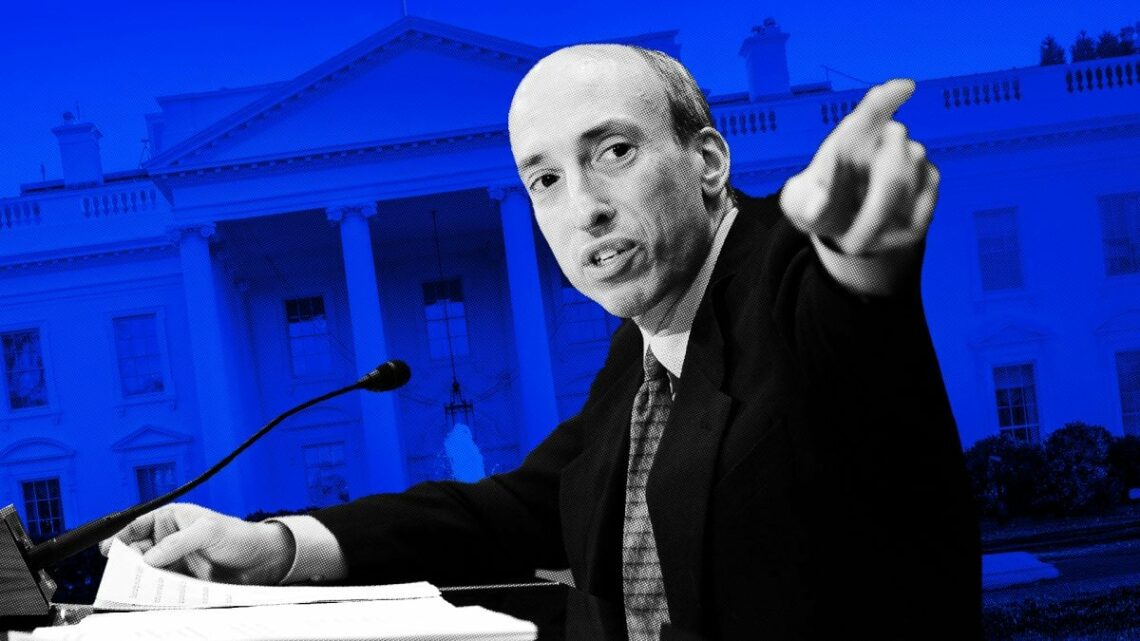

According to Peirce, there is unlikely to be any clear and definitive regulatory guidance for the crypto industry in the near future. Peirce has been a vocal opponent of the SEC’s enforcement actions and has publicly criticized the stance of SEC Chair gary gensler

He was awarded Treasury’s highest honor, the Alexander Hamilton Award, and also was a recipient of the 2014 Frankel Fiduciary Prize. He was born on October 18, 1957, into a Jewish family, in Baltimore, Maryland. Graduated from the University of Pennsylvania, earning a Master’s degree in Business Administration. Additionally, he is also a professor at the MIT Sloan School of management. He has served in various governmental roles since the 1990s, such as the treasury department, Sarbanes-Oxley, CFTC, Swaps, Enforcement, Libor investigation, Maryland Financial Consumer Protection Commission, Securities, and Exchange Commission.

Gary Gensler will probably keep on filling in as seat of the SEC until 2026, accepting his renunciation. He has expressed his desires to present crypto-related approach changes later on that include token commitments, decentralized finance, stablecoins, guardianship, exchange-traded resources, and advancing stages. A few officials as well as his kindred SEC magistrates have scrutinized Gensler for not giving adequate administrative direction on crypto, possibly prompting a standoff between Congress and the association.

The SEC, CFTC, and Financial Crimes Enforcement Network handle advanced resource guidelines in the U.S., however, each with various jurisdictional cases, bringing about an interwoven methodology that crypto firms should explore to work legitimately. Whether 2022 will see a more clear way for organizations in the crypto space is questionable, yet the cosmetics of the SEC’s initiative will fundamentally change following the takeoff of chief Elad Roisman in the first month of the year. Chief Allison Lee’s term is likewise set to terminate in June 2022. Chairman

“If we built a good regulatory regime, people would come. I think you will see that with MiCA. We are shooting ourselves in the foot by not having a regulatory regime in the U.S.,” Peirce said.

After the SEC’s announcement on April 14 that it intends to broaden the definition of ‘exchange’ to include decentralized finance (DeFi) platforms trading cryptocurrencies, Peirce issued a statement in response. Titled “Rendering Innovation Kaput,” Peirce’s statement was critical of the SEC’s proposal, citing concerns that it could stifle innovation in the crypto industry.

Also Read: Ripple News : Why XRP Wasn’t Registered? Ripple CEO Garlinghouse Speaks Out

“Stagnation, centralization, expatriation, and extinction are the watchwords of this release. Rather than embracing the promise of new technology as we have done in the past, here we propose to embrace stagnation, force centralization, urge expatriation, and welcome the extinction of new technology. Accordingly, I dissent,” she wrote.

Peirce has also expressed her admiration for the European Union’s swift development of its digital finance package. On April 20, the European Parliament approved the Markets in Crypto-Assets (MiCA) regulation, which provides a regulatory framework for the cryptocurrency industry in the European Union. The new legislation will bring the issuance of cryptocurrencies under institutional regulation and create a uniform regime for crypto-asset service providers across EU member states.

Source: Read Full Article