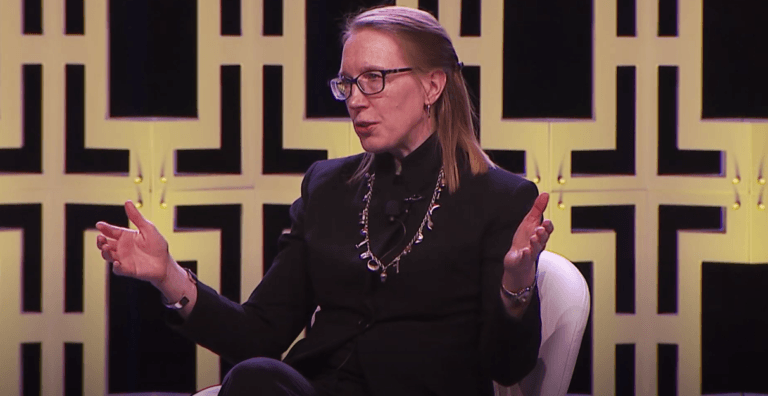

SEC Commission Hester Peirce Supports Spot Bitcoin ETFs

November 22, 2023Yesterday, in an interview with Bloomberg TV’s Kailey Leinz and Sonali Basak, SEC Commissioner Hester Peirce discussed various aspects of digital asset regulation and internal dynamics within the U.S. SEC.

On Regulatory Framework and Binance Case

Peirce emphasized the importance of proactively building a regulatory framework that allows companies to operate legally in the U.S. While she couldn’t comment on ongoing cases, including the SEC’s case against Binance, she highlighted the need for clarity in regulations to prevent issues currently seen in the industry.

On Remedies and Civil Charges

Discussing potential remedies in cases like Binance’s, Peirce noted that each case’s facts and circumstances differ. It’s common for criminal aspects to be addressed before civil ones, but she refrained from generalizing this approach.

On Crypto Industry’s Future

Peirce stressed the need for a proactive regulatory approach. She warned against shutting the industry out from traditional financial systems, which could lead to adverse outcomes for everyone involved.

Internal Dynamics at the SEC

Peirce clarified that her advocacy is not for the crypto industry per se but for clear regulatory guidelines. She expressed frustration shared by many in the industry over the lack of a clear regulatory framework, emphasizing the need for realistic guidelines to prevent future violations.

On Conversations Within the SEC

Regarding spot Bitcoin ETFs, here are the key points she made:

- Personal Advocacy for Spot Bitcoin ETFs: Peirce has been a vocal advocate for the approval of spot Bitcoin ETFs. She expressed her longstanding belief that there is no valid reason for the SEC to prevent the launch of such products.

- Each Application’s Unique Consideration: She emphasized that every application for a spot Bitcoin ETF should be judged on its own set of facts and circumstances. However, she noted that there have been several applications where she didn’t see a reason for their denial by the SEC.

- Nudge from the Court: Peirce referenced a recent court case that nudged the SEC regarding its stance on spot Bitcoin ETFs. This case likely pertains to a decision where the court found the SEC’s denial of a particular spot Bitcoin ETF application to be arbitrary and capricious.

- Future of Spot Bitcoin ETFs: While Peirce couldn’t comment on specific ongoing applications or predict the exact timeline for approval, she indicated that the court’s decision might influence how the SEC approaches future spot Bitcoin ETF applications.

On SEC’s Enforcement Approach

Peirce believes litigation is not the most effective regulatory tool and advocates for using other methods. Despite ongoing enforcement actions, she urges a more productive approach.

On Potential Changes Under the Gensler Administration

Peirce sees Congressional action as a significant factor that could change the SEC’s approach. She remains hopeful for a shift towards a more productive regulatory stance.

On Congressional Legislation

Peirce views Congress as the appropriate body to make decisions on crypto regulation, acknowledging the complexity of drafting legislation in this multifaceted field.

On Crypto Community’s Perception of the SEC

Peirce noted the SEC’s busy agenda, with many rules unrelated to crypto. She expressed concern that initial regulatory steps in crypto might force centralization or push businesses out of the U.S., which contradicts the decentralization ethos of crypto.

https://youtube.com/watch?v=ejwzqcWaW1o%3Ffeature%3Doembed

Source: Read Full Article