Jim Cramer's Alert: Prepare for Market Shocks After FOMC Press Conference on Sep 20

September 18, 2023Jim Cramer, the host of CNBC’s “Mad Money,” recently discussed various topics affecting the stock market, from the Federal Reserve’s upcoming FOMC meeting to earnings reports and IPOs. He emphasized that while the market has seen rallies, several factors could introduce turbulence.

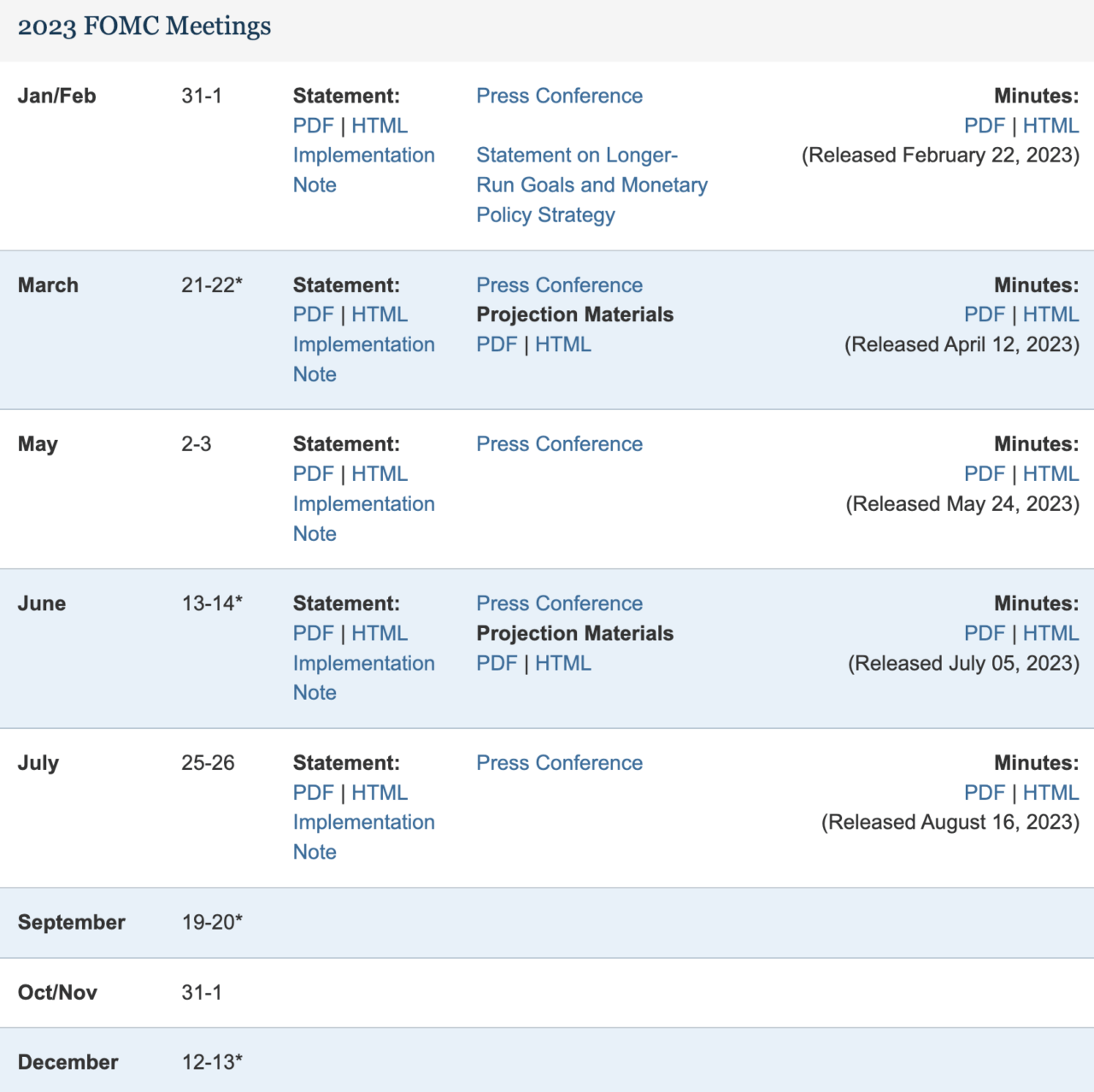

The Federal Open Market Committee (FOMC) is a crucial component of the U.S. Federal Reserve System responsible for overseeing open market operations, one of the three key tools of monetary policy. Comprising twelve members—including the seven members of the Board of Governors of the Federal Reserve System, the Federal Reserve Bank of New York president, and four rotating Reserve Bank presidents—the FOMC meets eight times a year to review economic and financial conditions.

During these meetings, the Committee determines the appropriate stance of monetary policy and assesses risks to its long-term goals of price stability and sustainable economic growth. Changes in the federal funds rate, the interest rate at which depository institutions lend balances at the Federal Reserve to other depository institutions overnight, are often decided during these meetings. These changes trigger events that affect other interest rates, foreign exchange rates, and various economic variables such as employment, output, and prices. Therefore, the FOMC’s decisions are closely watched as they broadly impact the U.S. economy, making their meetings highly significant.

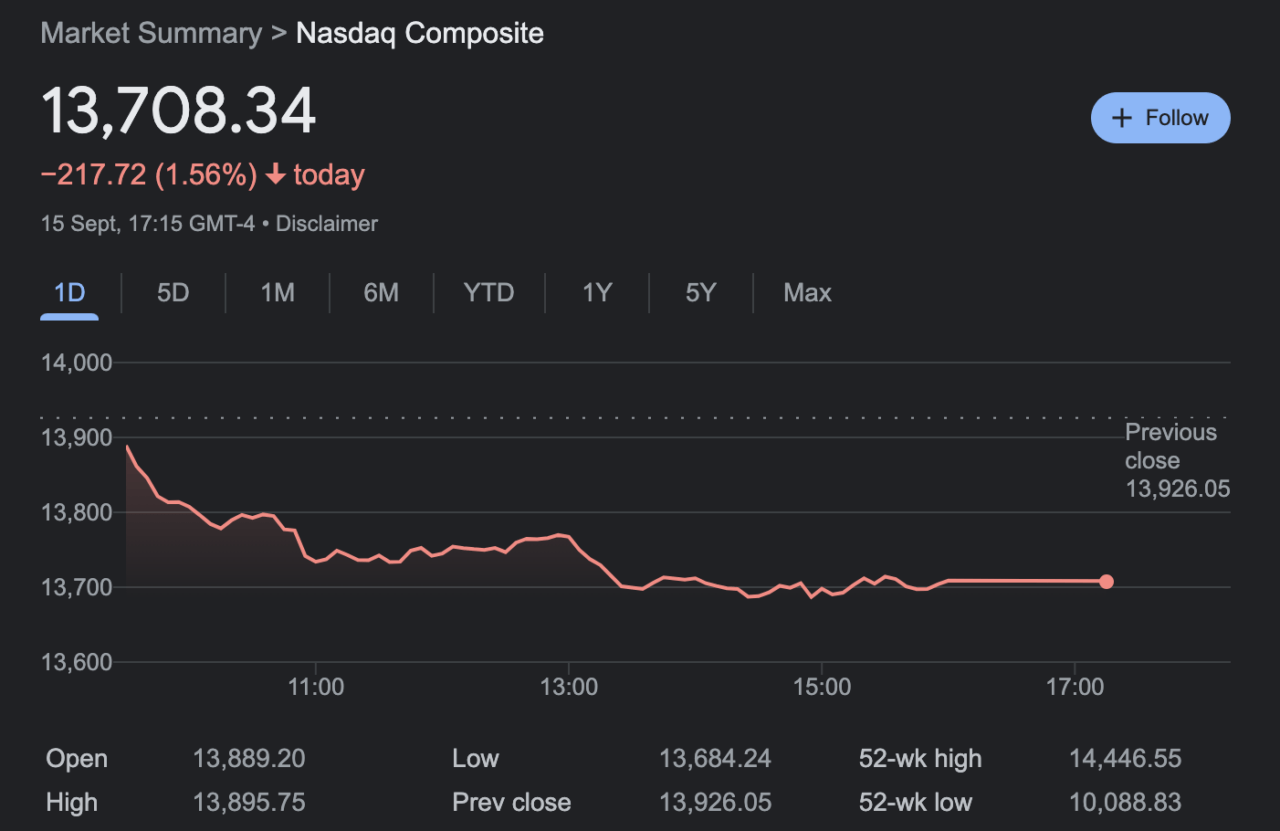

Market Performance and Data Points

Jim Cramer noted that the NASDAQ recently dropped by 1.56%, attributing the decline to disappointing data points that have temporarily halted the market rally. He mentioned that the market had previously rallied based on reports from Adobe and Lennar, but these companies failed to deliver exceptional results, causing some concern among investors.

Federal Reserve’s Upcoming Meeting

Cramer expressed significant concern about the upcoming FOMC meeting and subsequent press conference on September 20, 2023.

He indicated that Fed Chair Jerome Powell seems more focused on curbing inflation than on other economic factors like earnings, jobs, or corporate balance sheets. Cramer also pointed out the rising cost of crude oil, which is nearing $100, as a potential reason for Powell to maintain a hawkish stance during his statement and the following Q&A session.

Sector-Specific Insights

Cramer touched on various sectors and companies. He mentioned that Disney is hosting an investor meeting focused on its theme parks, which could provide valuable insights into the company’s strategy, especially in China. He also discussed the potential IPO of Instacart, stating that while it seemed promising a few years ago, the current market conditions make it less attractive.

Upcoming Earnings and Deals

Cramer talked about upcoming earnings reports from companies like FedEx and General Mills. He expressed concern that even a strong quarter might not be enough to boost FedEx’s stock price. Additionally, he mentioned Goldman Sachs’ involvement in the upcoming Birkenstock deal and suggested that Goldman Sachs stock might be a better investment than jumping on the Instacart IPO.

Auto Sector and Housing Market

Cramer highlighted AutoZone as a well-performing company in the auto sector, contrasting it with Advance Auto Parts, which has been struggling. He also mentioned that the Federal Reserve’s stance on inflation could impact the housing market, particularly if the Fed aims for more affordable housing options.

Final Thoughts

Cramer concluded by suggesting that investors should be cautious, especially given the lack of widespread concern about the upcoming Federal Reserve meeting. He implied that this complacency could be a sign that the market is not adequately prepared for potential announcements that could introduce volatility.

He said:

“The bottom line is when there’s a Fed meeting coming up in less than a week, and nobody seems worried about it, maybe you want to brace yourself for a little turbulence.“

https://youtube.com/watch?v=qiwBTat3dek%3Fstart%3D1%26feature%3Doembed

Source: Read Full Article