Dr. Nouriel Roubini Warns: 10% Global Market Correction Looms

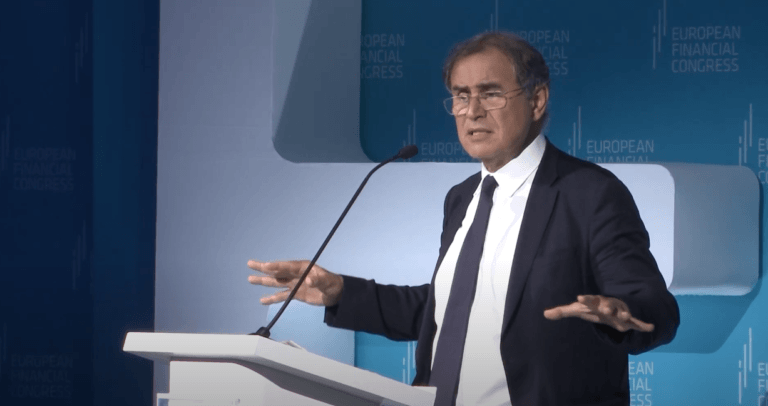

September 10, 2023Dr. Nouriel Roubini, CEO of Roubini Macro Associates and a leading authority on macroeconomics, has a history of making accurate economic forecasts. He gained widespread recognition for his 2006 warning about the impending global financial crisis, which came to fruition in 2008. With a rich academic background and extensive policy experience, Roubini has served as a consultant to major global institutions like the IMF and the World Bank. He is also a frequent commentator on business news programs and has authored several books on economics.

On September 1, 2023, Dr. Roubini was interviewed by Bloomberg TV during the Ambrosetti Forum in Cernobbio, Italy. The interview revolved around the state of the global economy, potential corrections in global equities, and the roles of central banks and China.

Global Economic Outlook

Roubini expressed that compared to six months ago, the risks of a hard landing for the global economy have reduced. However, he noted that the global economy is still on uncertain ground. He mentioned that while the Eurozone and the UK are already experiencing recessions, China is undergoing a structural slowdown. He added that the U.S. economy’s fate remains undecided, with possibilities ranging from a soft landing to a short and shallow recession.

Factors Affecting the U.S. Economy

Roubini says that in the United States, despite the Federal Reserve hiking interest rates above 5%, the economy has shown resilience. Roubini mentioned that this could be both good and bad news. He pointed out that while it indicates a potential soft landing, it also suggests that the Federal Reserve may need to hike rates further, increasing the risk of a recession.

Changes Over the Last Six Months

Roubini attributed his slightly more optimistic outlook to several factors. These include the unwinding of negative supply shocks from the COVID-19 pandemic, expansionary fiscal policy in the U.S., and reduced geopolitical tensions. However, he cautioned that the resilience shown by some economies, particularly the U.S., should not be generalized to the global economy.

Stagflation and Structural Factors

When asked about Europe’s ability to avoid stagflation, Roubini pointed out that the causes are more structural than cyclical. He mentioned decoupling, geopolitical tensions, and climate change as factors that are likely to reduce growth and increase production costs in the medium term.

China’s Economic Slowdown

Roubini described China’s slowdown as structural, citing factors like an aging population, state capitalism, and geopolitical pressures. He estimated that China’s potential growth has reduced to 3-4%, a significant drop from previous levels.

Market Predictions

Roubini warned that if the global economy weakens and central banks continue to fight inflation, there could be a 10% correction in global equity markets in the second half of the year.

UK’s Economic Dilemma

The Bank of England faces a challenging situation, according to Roubini. With the UK economy slowing down and core inflation remaining high, the central bank is caught in a dilemma. Roubini also mentioned that fiscal policies are at odds with monetary policies, making it difficult to achieve price stability.

Future of UK Economy

Roubini suggested that the UK should focus on technology and innovation to increase potential growth. He mentioned that the UK has strong academic research, venture capital firms, and startups that could help in this regard.

Bank of Japan’s Policy

Roubini believes that the Bank of Japan will eventually phase out yield curve control but will do so cautiously to avoid making mistakes.

https://youtube.com/watch?v=2Xa8ZCzeHvU%3Ffeature%3Doembed

Source: Read Full Article