Pound plunges again despite Truss quitting as dollar and euro surge

October 21, 2022Redwood: Not in Government power to control pound

We use your sign-up to provide content in ways you’ve consented to and to improve our understanding of you. This may include adverts from us and 3rd parties based on our understanding. You can unsubscribe at any time. More info

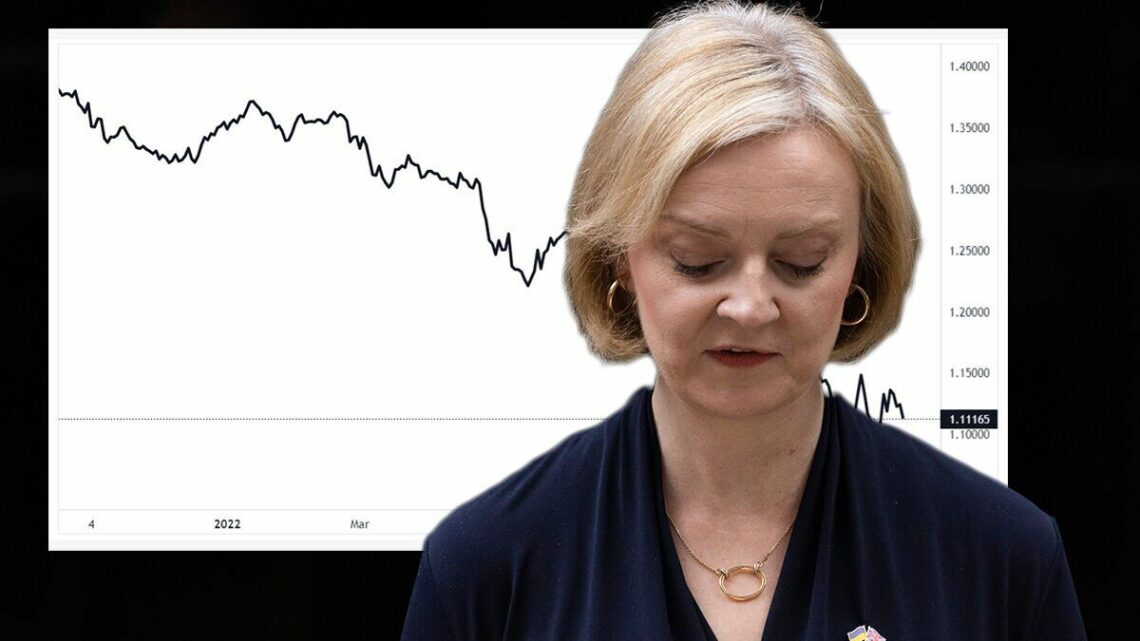

The pound has made another steep decline against the dollar after weeks of market uncertainty as turmoil at the top of Government leaves markets jittery over Britain’s economic future. Sterling had rallied after Liz Truss sacked her Chancellor, Kwasi Kwarteng, and his successor, Jeremy Hunt, rowed back on many of the pledged in their mini-budget.

The fiscal event, on September 23, caused upset in the currency and gilt markets, with the now-outgoing Prime Minister admitting they had gone “too far, too fast” with their economic plans.

The pound dropped to a low of $1.07 against the dollar following the event last month, but had since recovered partially to $1.14 on Tuesday.

However, with Ms Truss’s resignation after just 44 days in office has thrown fresh uncertainty not only who will be leading the nation next week, but what the fiscal policy of the Government may look like in the weeks and months to come as Britain braces for a recession.

Sterling had started today at $1.12, but has since slipped to $1.11, and market analysts see a continued descent as likely.

Against the Euro, it similarly slipped to €1.11 following the mini-budget, before returning to €1.16 on Thursday. After being closer to €1.15 this morning, as of 8.30am it slipped to a low €1.14.

Despite the intra-day fluctuations, the pound has been on a slow decline against the dollar since last year. It has also seen an overall downward trend against the euro since March.

Patrick Bennett, a strategist at Canadian Imperial Bank of Commerce, is now predicting that sterling may slide to $1.09 by the end of the year.

He told Bloomberg: “I expect GBP to remain pressured and international investor confidence in gilts and sterling will take time to recover.

“After personnel changes to date, the hurdle to regain that confidence keeps getting higher.”

More to follow…

Source: Read Full Article