10 Safe Stocks To Bet In Volatile Market

March 20, 202310 high dividend paying stocks across sectors that are expected to maintain or even increase their pay-outs in FY23 thanks to faster earnings growth in the last four quarters.

Equity dividend is the least appreciated aspect of investing in stocks, but a portfolio of high dividend paying companies is a great way to earn a steady stream of income.

Besides, this is over and above the capital appreciation that one gets from equities.

If the portfolio is big enough, the annual dividend income can become a good source of passive or second income for the investor.

Dividend paying companies also tend to have a superior balance sheet and are most often more profitable and generate more cash flows from operations, compared with their peers that pay little or no dividend.

Hindustan Zinc (HZL)– the top dividend paying company in the metals and mining space — is the most consistent performer on the bourses and its stock price has outperformed most of its peers in the longer term.

The same can be said about the other companies in Business Standard‘s list such as ITC, Bata India, Bayer CropScience, Petronet LNG, and Akzo Nobel, among others.

In other words, a good dividend paying company offers the best of both worlds — a steady appreciation in the initial capital and an annual income in the form of dividend.

Investment for equity dividend is also a good way to hedge one’s equity portfolio from the price volatility of shares.

For example, the benchmark BSE Sensex has been range bound in the last one-and-a-half years, which has translated into poor capital returns for most diversified equity portfolios.

But many companies continue to pay generous dividends with yields matching or even higher than the interest on bank fixed deposits.

However, big dividend payouts weigh on a company’s share price and become self-defeating if payouts are not financially sustainable and hurt the company’s ability to invest in expansion.

This is why it’s important to invest in companies where the dividend payout keeps pace with its earnings growth.

Here are 10 high dividend paying stocks across sectors that are expected to maintain or even increase their pay-outs in FY23 thanks to faster earnings growth in the last four quarters.

These stocks currently offer dividend yields ranging from a low of 3.1 per cent in the case of ITC to a high of 7.7 per cent in the case of Coal India.

In comparison, the BSE Sensex currently offers a dividend yield of 1.2 per cent.

All 10 stocks reported growth in net profit and net sales in the trailing 12-month period ended December 2022.

This means, investors can expect higher payout in FY23 than in FY22.

These companies also have strong balance sheets with little or no debt and high return on equity (RoE).

The latest RoE for these companies ranges from 23 per cent in case of Redington to 52 per cent for Coal India, based on their TTM net profit and net worth at the end of H1FY23.

This is at least 50 per cent higher than the Sensex companies’ average RoE of around 15 per cent.

These stocks have been selected from the BSE 500 universe based on their relative rank on financial parameters such as dividend yield, RoE and revenue, operating profit and net profit growth in the TTM period.

Coal India

Coal India (CIL) is at the top of the list with a dividend yield of 7.7 per cent, compared with 1.2 per cent offered by the Sensex.

CIL has historically been one of the biggest dividend payers in India — it paid out Rs 10,477 crore in financial year 2021-2022 (FY22) or Rs 17 per share — and is expected to continue with a hefty pay-out in FY23 as well.

CIL’s net sales rose 29 per cent year-on-year (YoY) in the trailing 12-month (TTM) period ended December 2022, while its net profit jumped 92 per cent YoY.

The stock is trading at a P/E (price-to-earnings) ratio of 4.5x — one of lowest among index stocks — and the return on equity (RoE) was high at 52 per cent.

The stock has risen around 20 per cent in the last 12 months and there is potential upside of 11 per cent from current levels.

Hindustan Zinc

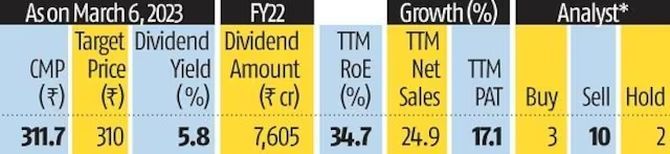

The country’s top zinc and silver producer, Hindustan Zinc (HZL), is among the top dividend payers in India Inc with a current dividend yield of 5.8 per cent.

Historically, HZL has been the most profitable and cash rich metal and mining firm in India with a debt-free balance sheet.

In FY22, HZL was among the top dividend payers in India Inc with a total pay-out of Rs 7,605 crore or Rs 18 per share.

Investors can expect a hefty dividend from HZL in FY23 as well, given the 17.1 per cent YoY growth in net profit in the TTM period.

The stock is currently trading at a P/E and P/B (price-to-book value) ratio of 12.5x and 4.5x, respectively.

Oil India

The upstream oil and gas producer is another big dividend payer, with a dividend yield of 5.7 per cent at its current share price.

The company paid a total dividend of Rs 1,545 crore (Rs 15.45 billion) or Rs 14.3 per share in FY22.

Analysts expect Oil India to increase its dividend pay-out in FY23 as its net profit has more than doubled in the TTM period ended December 2022, while its net sales rose 42.1 per cent YoY.

Oil India’s RoE is also healthy at 24.5 per cent and debt-to-equity ratio of 0.5x in H1FY23 is pretty comforting.

The stock valuation is also cheap at a trailing P/E multiple of 3x and P/B of 0.9x.

Petronet LNG

The government-owned importer of liquified natural gas (LNG) and storage terminal utility is another big dividend payer with a current dividend yield of 5.2 per cent.

The company paid a total dividend of Rs 1,725 crore (Rs 17.25 billion) or Rs 11.5 per share in FY22.

Analysts expect the company to maintain its dividend pay-out in FY23, given the 6.5 per cent YoY growth in its net profit in the TTM period.

Petronet has faced earnings headwinds in the last two years due to a sharp rise in natural gas prices, but its finances remain strong with RoE of 24.1 per cent and debt-equity ratio of 0.2x in H1FY23.

Bata India

Bata India’s strong balance sheet with net cash position, healthy free cash flow generation and returns profile coupled with huge runway for industry growth are growth levers, believes Motilal Oswal Research.

The growth of the sneakers segment is a positive; the category which generates a third of revenues grew over 20 per cent in the December quarter, led by digital channels.

Good traction in the premium portfolio (aided by new products/designs), strong expansion of distribution, and growth in the digital business are expected to drive top line growth in the long run.

In the near term, the company may underperform peers on the growth and margin fronts, given the sluggish show of lower priced open footwear segment, weaker channel mix and higher investments in IT and marketing.

Bayer CropScience

Bayer CropScience, owned 71.43 per cent by its German parent, is one of the major players in the agrochemical sector.

While its overall market share is over 15 per cent, the company has a 40-45 per cent share in the rice hybrids segment.

In addition to strong brand recall and superior product offerings, the company will benefit from new launches and higher global crop prices.

After the December quarter earnings, the Bayer management highlighted that it was continuing on its trajectory with sustained growth investments, while focusing on maintaining profitability despite inflationary pressures and other external challenges.

While healthy profitability in corn crop may lead to higher acreages, higher crop protection channel inventory in the industry is expected to weigh on segment’s profitability, says Elara Securities.

AkzoNobel India

The paint maker, owned 74.8 per cent by its Dutch parent, reported a revenue growth of 8 per cent in the December quarter, led by a strong performance across the coatings business.

Double-digit margins were achieved on the back of profitability management and operating efficiencies, the company said

Best growth on an annual basis in the paint industry led to market share gains given its efforts to boost distribution presence as well as growth from new launches in the waterproofing and economy emulsions.

Akzo’s industrial paints generates highest return on capital employed (RoCE) among peers, according to ICICI Securities, as it offers premium and niche problem solution products to multiple customers instead of selling to a handful of auto original equipment makers.

Redington India

Redington India, a leading distributor of IT and mobility products, offers logistics and supply chain management services to companies in India, West Asia and Africa.

Growth over the last three years was led by the work-from-home trend and technology adoption.

The company was able to gain market share at the expense of smaller players while margin expansion was led by change in revenue mix and increased demand/lower supply.

Strong demand for enterprise IT products and pent-up demand for mobility devices would help Redington clock 16.9 per cent annual revenue growth during FY22-24, says Quantum Securities

A diversified product portfolio and geographical footprint offers comfort as does its attractive valuation of around 10x FY24 earnings.

Rashtriya Chemicals & Fertilizers

Government-owned Rashtriya Chemicals & Fertilizers (RCF) also makes it to the list with a dividend yield of 4 per cent at its current share price.

It paid a total dividend of Rs 212.4 crore (Rs 2.124 billion) in FY22 or Rs 3.9 per share.

Investors can expect hefty dividend pay-out in FY23 as its net profit jumped 94.2 per cent YoY in the TTM period ended December 2022, while net sales rose 90 per cent.

RCF remains financially healthy with a RoE of 23.4 per cent and a debt-equity ratio of 0.67x in H1FY23.

The stock is currently trading at a low valuation, with P/E of 5.8x and P/B ratio of 1.3x.

ITC

The cigarette, FMCG, hotels and paper major is better placed than its competition over the next few quarters.

More than 80 per cent of its profits are largely protected compared with rivals, who are grappling with the twin issues of volume growth and hyperinflation, says Phillip Capital.

Cigarette volumes have recovered to pre-Covid levels led by better execution, new launches, stable tax regime and market share gains on the back of clampdown on illicit trade by authorities.

The company trades at about 21 times its FY25 estimated earnings with return ratios (RoE and RoCE) in the 30-36 per cent band.

ITC is the cheapest stock in the FMCG space in terms of P/E valuation, and a high dividend yield of over 3 per cent; dividend pay-out was over 80 per cent.

While ITC has been on a roll over the past few quarters on the operational front, investors should note that any sharp increase in tax on cigarettes would be a major risk for the stock.

Disclaimer: This article is meant for information purposes only. This article and information do not constitute a distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products/investment products mentioned in this interview to influence the opinion or behaviour of the investors/recipients.

Any use of the information/any investment and investment related decisions of the investors/recipients are at their sole discretion and risk. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.

Source: Read Full Article