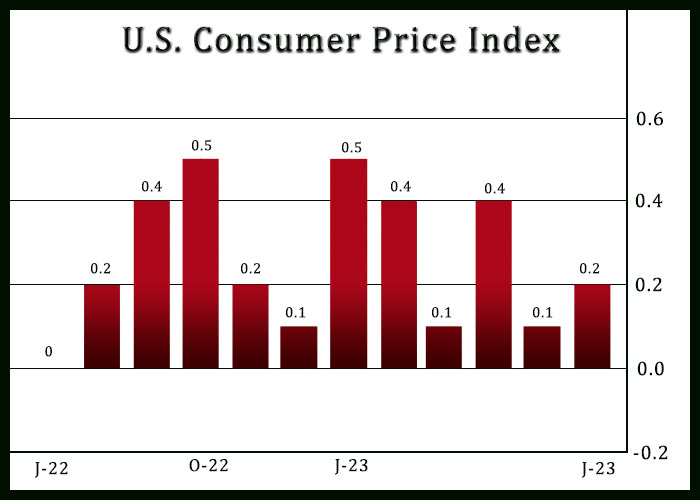

U.S. Consumer Prices Rise 0.2% In June, Slightly Less Than Expected

July 19, 2023Consumer prices in the U.S. increased by slightly less than expected in the month of June, according to a report released by the Labor Department on Wednesday.

The Labor Department said its consumer price index rose by 0.2 percent in June after inching up by 0.1 percent in May. Economists had expected consumer prices to climb by 0.3 percent.

The modest increase in consumer prices largely reflected a 0.4 percent advance in prices for shelter, which accounted for over 70 percent of the price growth.

Prices for food also inched up by 0.1 percent amid a 0.4 percent increase in prices for food away from home, while energy prices climbed by 0.6 percent.

Excluding food and energy prices, core consumer prices still increased by 0.2 percent in June after rising by 0.4 percent in May. Core consumer prices were also expected to rise by 0.3 percent.

The Labor Department noted the uptick in core consumer prices reflected the smallest monthly increase since August 2021.

Higher prices for shelter, motor vehicle insurance, apparel, recreation, and personal care were partly offset by lower prices for communication, used cars and trucks, and household furnishings and operations.

The report also showed the annual rate of consumer price growth slowed to 3.0 percent in June from 4.0 percent in May. Economists had expected the rate of growth to slow to 3.1 percent.

The annual rate of core consumer price growth also decelerated to 4.8 percent in June from 5.3 percent in May. The rate of growth was expected to slow to 5.0 percent.

“Fed officials will be relieved to see the deceleration in core CPI, in particular, but the pace still remains too high for comfort,” said Nationwide Chief Economist Kathy Bostjancic. “As such, we still look for the Fed to raise rates another time at the July 26th policy meeting.”

She added, “However, if soft inflation readings persist throughout the summer, coupled with some slowing in economic activity, it would support our view that the Fed will forgo another rate hike, and instead hold the fed funds rate at an elevated 5.25% – 5.5% range for the remainder of the year.”

On Thursday, the Labor Department is scheduled to release a separate report on producer price inflation in the month of June.

Producer prices are expected to rise by 0.2 percent in June after falling by 0.3 percent in May, while the annual rate of producer price growth is expected to slow to 0.4 percent in June from 1.1 percent in May.

Source: Read Full Article